Selling and Buying Homes in Orange County’s Tight Market

Are you thinking of selling your home? Or maybe you're in the market to buy a new home? The current Orange County housing market has advantages, challenges, and unique dynamics that buyers and sellers should consider.

Inventory Shortage Continues to Plague Orange County Real Estate Market

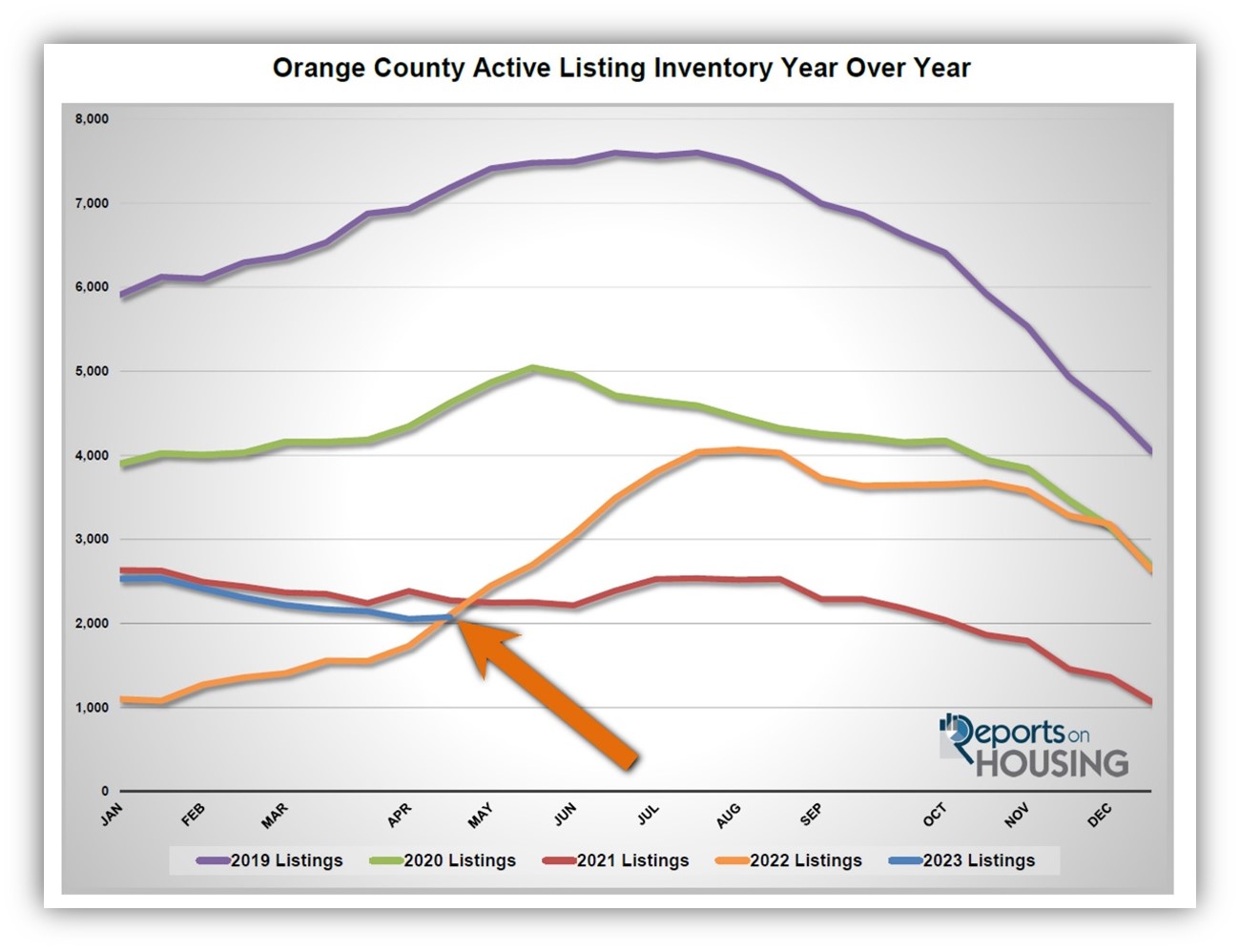

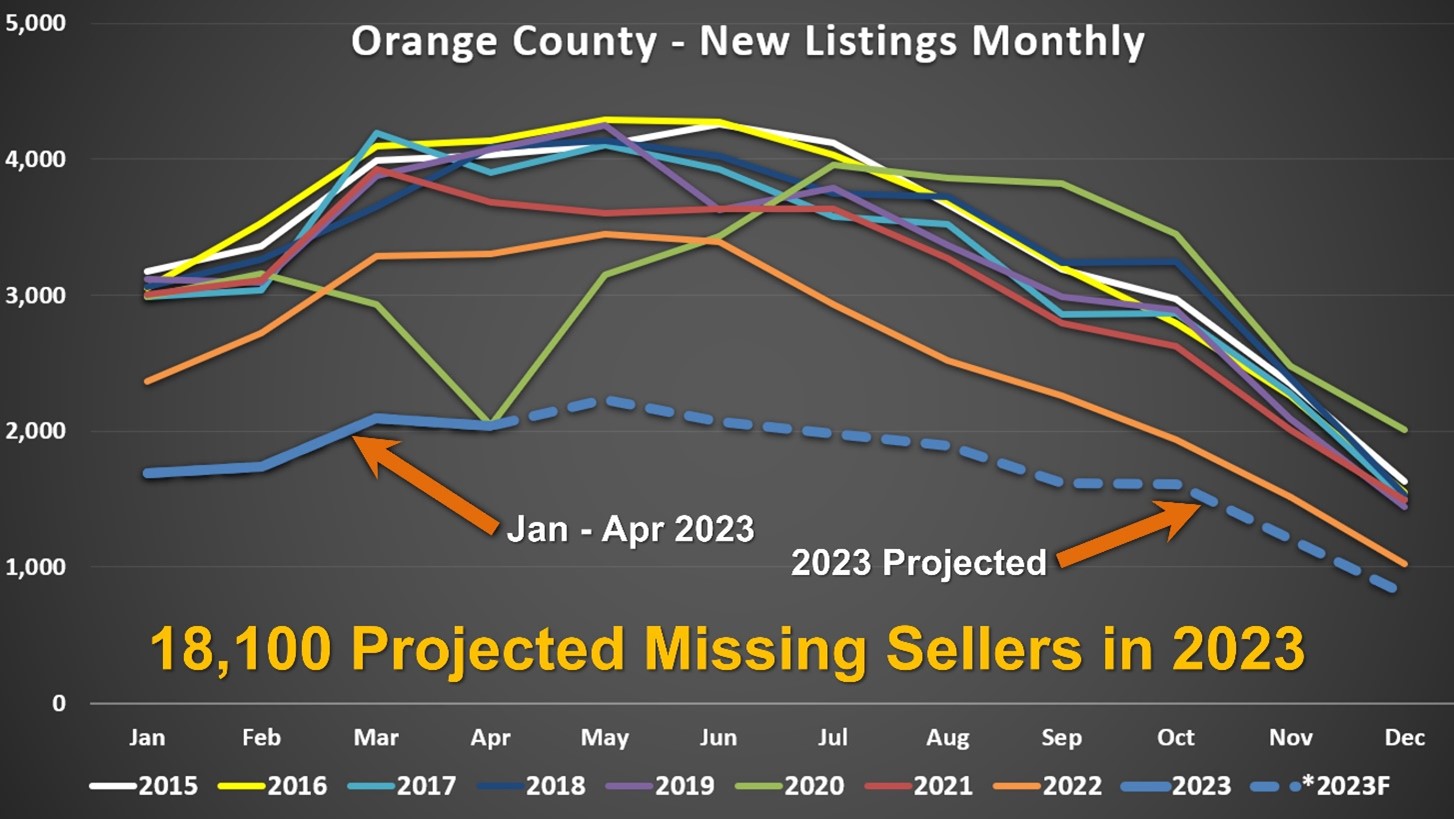

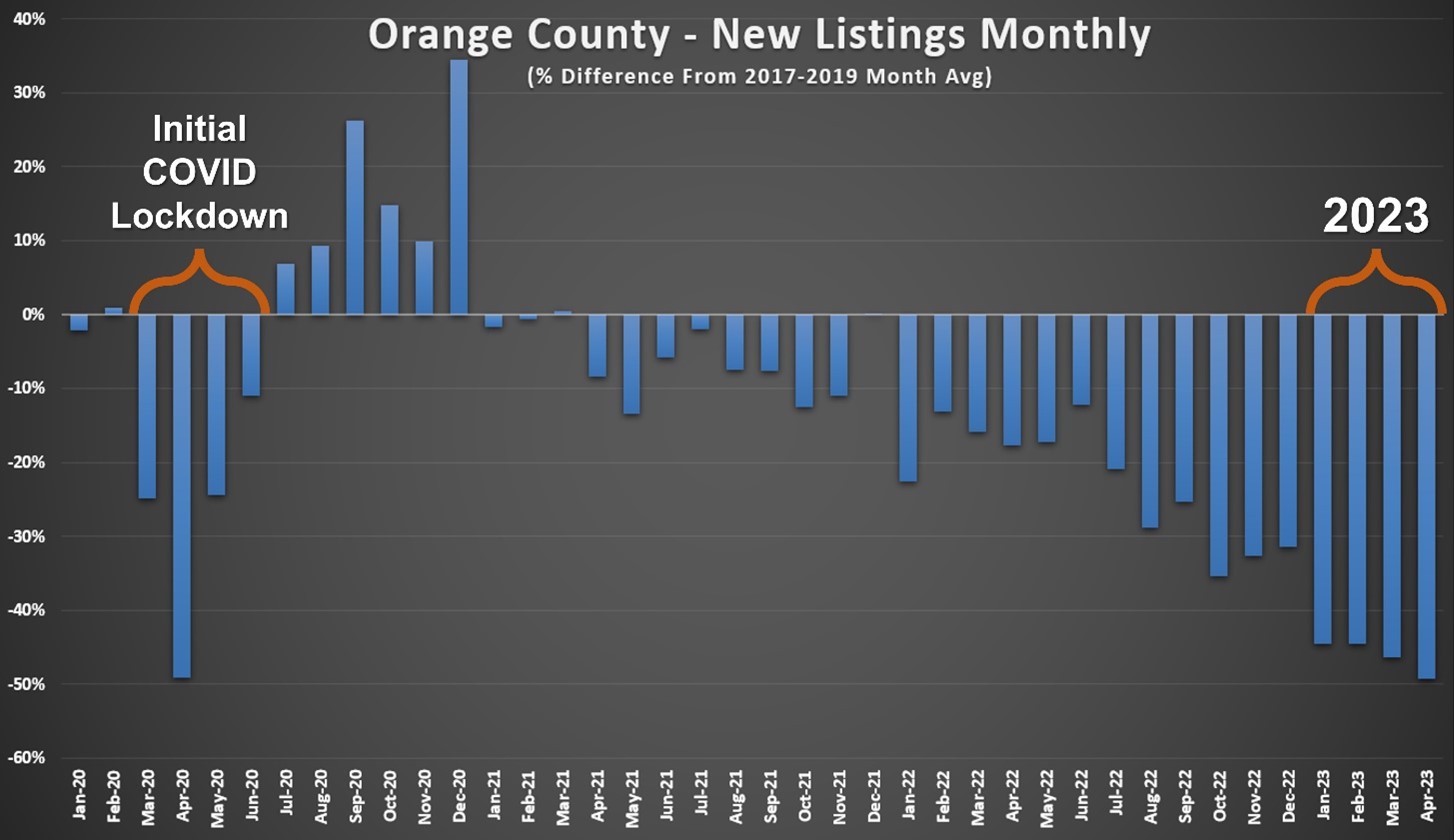

Home buyers and sellers in Orange County should know that the active inventory has recently increased slightly, but fewer homes remain on the market than last year. It is currently more challenging for buyers to find a suitable home due to a lack of sellers coming on the market. Any new homes that hit the market will be bid on swiftly, making it competitive for buyers. On the other hand, home sellers have an advantage due to the high demand for homes on the market, but they must price their homes correctly and carefully gauge the market.

Home buyers and sellers in Orange County should know that the active inventory has recently increased slightly, but fewer homes remain on the market than last year. It is currently more challenging for buyers to find a suitable home due to a lack of sellers coming on the market. Any new homes that hit the market will be bid on swiftly, making it competitive for buyers. On the other hand, home sellers have an advantage due to the high demand for homes on the market, but they must price their homes correctly and carefully gauge the market.

Homeowners in Orange County continue to hold onto their homes due to their low fixed-rate mortgage. Until mortgage rates drop, it is unlikely that there will be a substantial increase in seller activity. Orange County’s inventory is expected to grow slowly from here until it peaks sometime over the summer between July and August.

Implications for Home Buyers

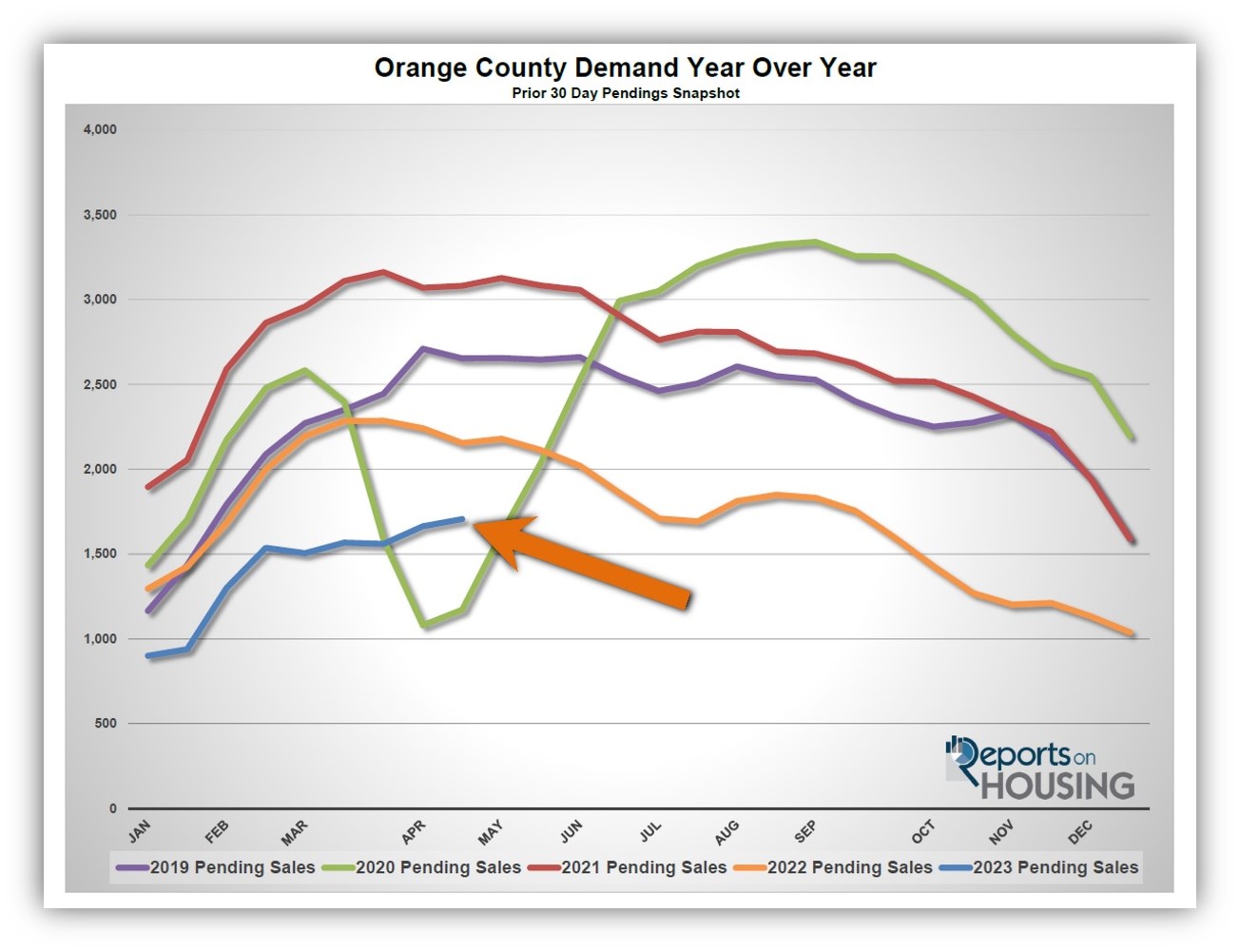

Demand for homes in Orange County, California, increased by 3% in the past few weeks (as of May 2, 2023), but it is still lower than pre-pandemic levels. This increase in demand is a result of a low inventory of available homes and high mortgage rates, which keeps some homebuyers from entering the market. Due to the scarcity of available homes, the market is highly competitive, with buyers often competing against each other and offering above asking prices. Homebuyers who are ready to purchase a home must be prepared to act fast and be flexible in their offers. And while programs like the CalHFA Dream For All down payment assistance program will come and go, there are still plenty of buyers making offers in today’s market.

Demand for homes in Orange County, California, increased by 3% in the past few weeks (as of May 2, 2023), but it is still lower than pre-pandemic levels. This increase in demand is a result of a low inventory of available homes and high mortgage rates, which keeps some homebuyers from entering the market. Due to the scarcity of available homes, the market is highly competitive, with buyers often competing against each other and offering above asking prices. Homebuyers who are ready to purchase a home must be prepared to act fast and be flexible in their offers. And while programs like the CalHFA Dream For All down payment assistance program will come and go, there are still plenty of buyers making offers in today’s market.

Implications for Home Sellers

Home sellers in Orange County currently have a strong advantage in the market, as the expected market time for a home to sell at the current buying pace is only 37 days, the lowest it has been since May 2022. This low expected market time signifies that the market is highly competitive, mostly due to the lack of supply rather than record-breaking demand. Sellers who wish to maximize their home’s value should list their home soon and aim to create a competitive bidding environment to get the best possible price. Additionally, as mortgage rates fall, more sellers are likely to enter the market, increasing supply, which will help to balance the current supply-demand imbalance.

The Orange County housing market is highly competitive due to low inventory and high demand. Homebuyers should be prepared to act fast and be flexible with their offers. At the same time, home sellers should take advantage of the current market conditions to maximize their home’s value and create a competitive bidding environment.

Advantages of Selling a Home in Orange County's Market

With a constrained inventory due to fewer home sellers putting out their properties, it's a seller's market in Orange County. This trend was deepened by the high mortgage rate environment that has prevented many homeowners from selling their homes. If you're considering selling your home, this may be a great time to take advantage of high demand and low supply to sell quickly and at a potentially higher price than during a buyers' market.

The lack of sellers means you could have more interested buyers, leading to bidding wars, which can increase the final purchase price. The pandemic has also brought a new set of needs for many home buyers, such as a need for more space, a backyard, or a home office setup, which could make your property more attractive if it meets these requirements.

Another advantage for home sellers in the current market is that interest rates are rising; therefore, many homeowners are staying put to enjoy low fixed monthly payments. They may sell when the rates drop to 5.5% or lower. Therefore, if you choose to sell, acting fast is important.

Although it will be competitive for a seller when they are buying their next home, using programs like the Buy Before You Sell will help to put a move-up buyer in a competitive situation when competing against other buyers. The Buy Before You Sell allows a seller to buy their move-up property with a non-contingent offer even if their current property is not listed for sale.

Advantages of Buying a Home in Orange County's Market

Advantages of Buying a Home in Orange County's Market

While it's a seller's market, that doesn’t mean finding a home that fits your needs is impossible. One of the advantages of buying a home now is the favorable interest rates relative to last year. Rates are more favorable for buyers than in 2022, when they rose significantly, making it less likely for homeowners to sell and reducing inventory.

However, the limited inventory in Orange County means less choice regarding available properties. You may need to act quickly and compete with other interested buyers in a bidding war to secure an attractive property. The pandemic and its effects have also led to increased demand for homes with specific features such as a home office, backyard, or pool, which means that a home that meets your requirements may be more expensive.

Conclusion: Orange County Home Market Dynamics

The housing market in Orange County has seen a significant change since COVID-19's emergence. While constrained inventory presents challenges, it also offers opportunities for both homebuyers and sellers. Sellers can take advantage of the current demand and potentially receive a quick and profitable sale, while buyers can enjoy lending rates that are more favorable than last year. The market will continue to evolve, and when rates drop to 5.5% or lower, more homeowners may choose to list their homes for sale. However, for now, Orange County’s inventory remains limited, which means buyers must act quickly to secure a home that meets their needs, while sellers should consider the favorable market conditions to gain maximum benefits from selling their home.

Authored by Tim Storm, an Orange County Loan Officer and Mortgage Advisor for Arbor Financial Group (NMLS ID 236669). MLO 223456. - Please contact me at 949-829-1846. I will prepare a custom Total Cost Analysis which will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of your scenarios so that you can fully understand the numbers BEFORE starting the loan process.