Dream for All | Down Payment Assistance for Orange County Home Buyers

Dream for All is a newly released Down Payment Assistance program from the California Housing Finance Agency (CalHFA). This program provides Down Payment Assistance up to 20% of the purchase price. There is an equity share component to this program, but for most First Time Buyers, this program will provide the boost needed to buy a home in Orange County, Los Angeles County, Riverside and San Bernardino Counties, and all other counties in California.

High-Cost counties like Orange County have been especially difficult for first-time buyers to break into. With the average home price in Orange County for sales in February 2023 being $955,000, the required down payment is the number one reason why buyers can’t buy in the OC. Number two is the payment for a home in this price range. The Dream for All program solves both problems. Not only will this program provide a down payment, but there is also no monthly payment for the “silent 2nd”. Below are some of the highlights of this program.

- Must be a First time Buyer – someone who has not owned a home within the last three years

- Non-Occupying co-borrowers are not allowed

- The minimum FICO score is 680

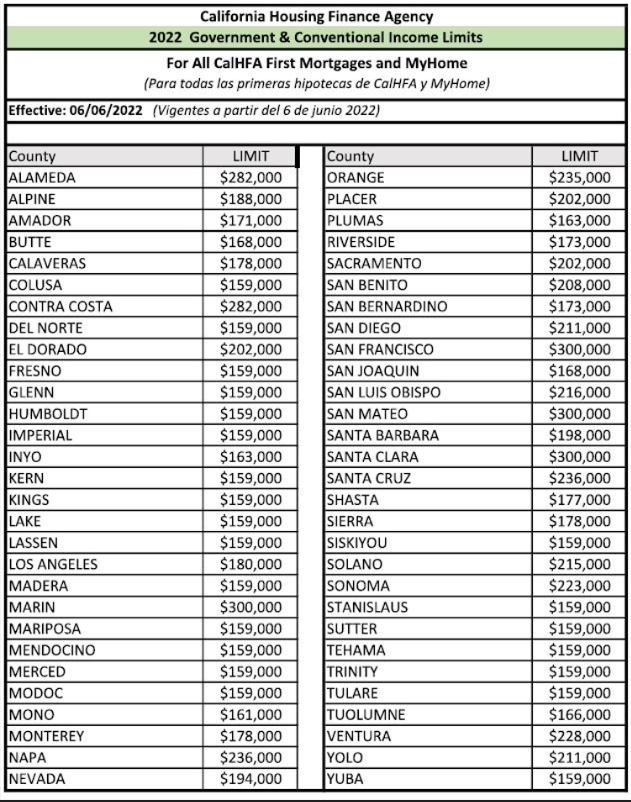

- The Buyer must meet income limits for the county they are buying in. Limits listed below

- No maximum purchase price

- Conventional (Fannie Mae) financing. This is not FHA or VA. (VA already offers 100% financing for Veterans in Orange County, CA)

- The Down Payment Assistance is 20% of the purchase price. It can go towards the down payment and closing costs.

- Max Combined Loan to Value is 105%. If the buyer needs funds for closing costs, they will use 15% for the down payment and the remaining 5% for closing costs. This would be enough to buy out the Mortgage Insurance.

- The Down payment is recorded as a second on the Deed.

- There is no monthly payment on the 2nd.

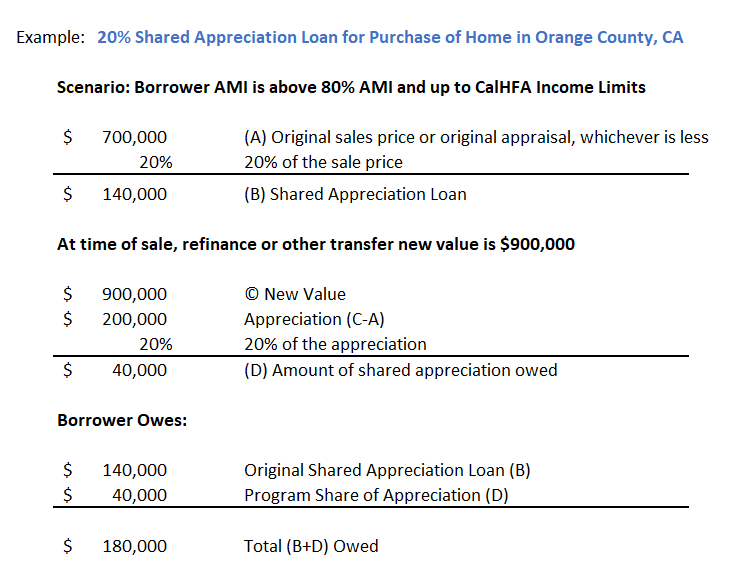

- Shared Appreciation – the % of shared appreciation equals the % of Down Payment Assistance. For example, if the buyer requests the full 20% Down Payment Assistance, then when the home is sold, the original 20% Second will be paid off, as well as 20% of any appreciation above the original purchase price.

- Two home buyer courses need to be completed. The standard CalHFA Homebuyer Education and Counseling course and a separate course specifically for shared appreciation loans.

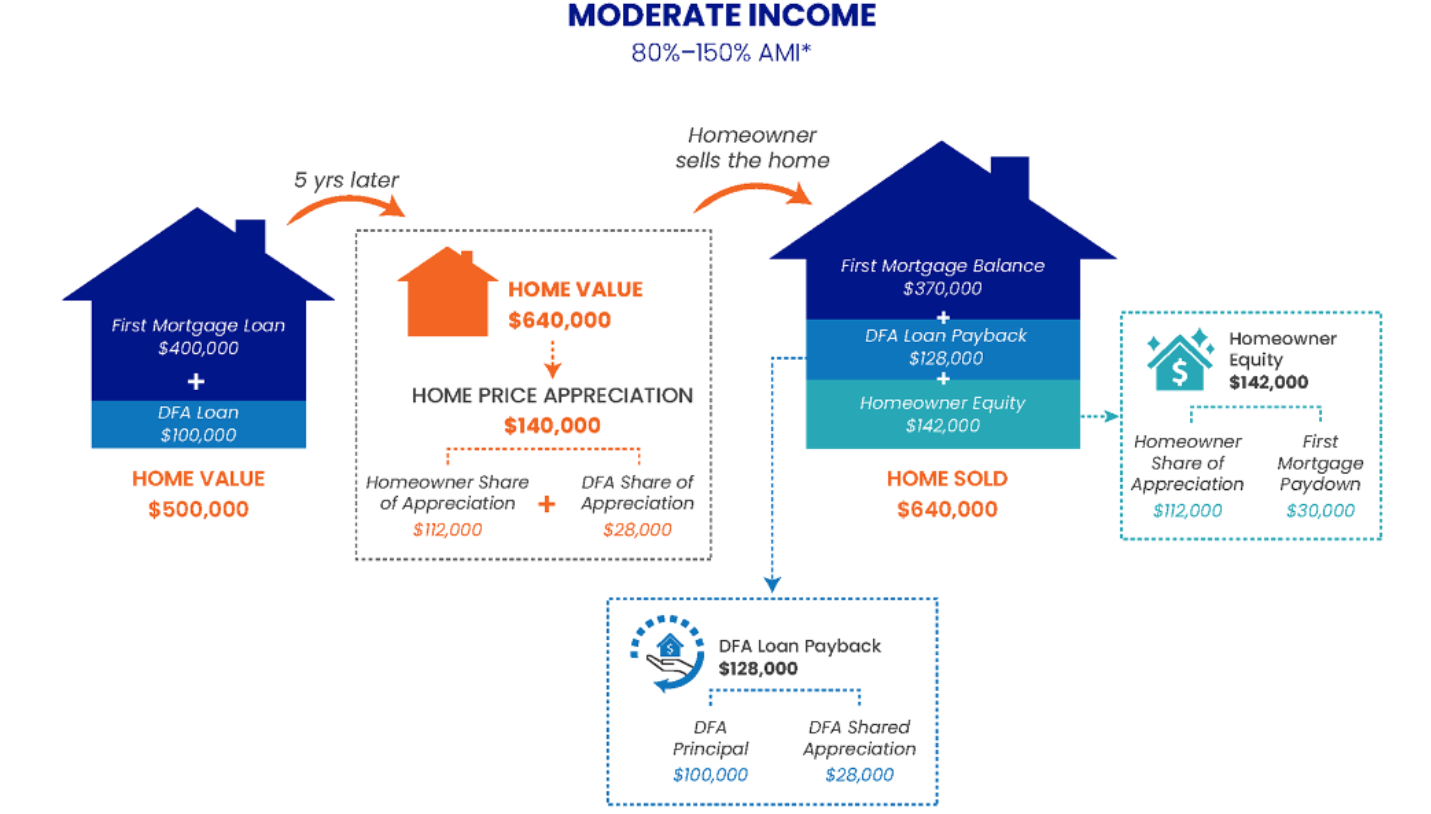

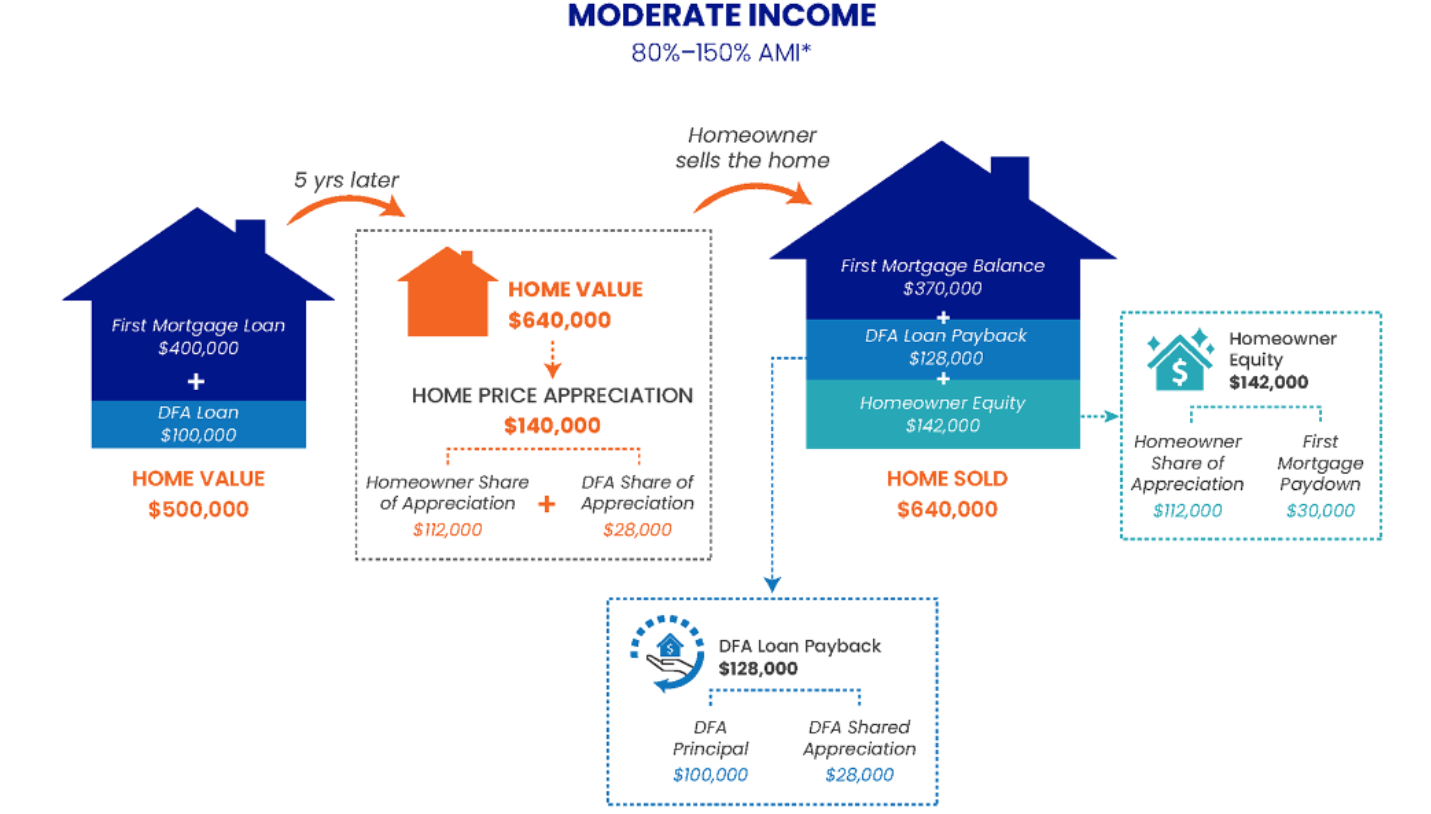

How Shared Appreciation Works on the Dream for All

Example: The Buyer/borrower has income between 80% and 150% of the Adjusted Median Income (AMI) for the county the property is located within.

- Dream for All loans 20% of the home purchase price.

- The homeowner pays back the original loan amount plus 20% of any appreciation in the home’s value.

Income Limits for the Dream for All Program

Borrowers must have a household income below the limits shown. The income limits are fairly generous, as is needed to qualify for a home in Orange County or southern California. In Orange County the income must be under $235,000. The Los Angeles County limit is $180,000. The Riverside and San Bernardino county limits are $173,000. And the San Diego income limit is $211,000. Below is the breakdown for all counties in California.

Dream for All: What do the Numbers Really Look Like?

I prepared a few examples of the numbers for a home buyer in Orange County using the Dream for All program. As a First Time Buyer, it is critical that you”know the numbers.” You need to know how much money is needed to close, if any. It is critical to know the full payment, including Principal, Interest, Taxes, Insurance, Mortgage Insurance (if needed), and HOA dues. Make sure the payment fits into your budget. Click on the video link below for a thorough walk-through of the numbers for a $700,000 purchase price, assuming a 20% Down Payment Assistance 2nd. For this example, I am comparing using the full 20% for a down payment, which means the buyer needs to pay the closing costs and prepaid expenses unless they can negotiate to have the seller pay the buyer’s costs. The real estate market is very competitive right now, so it may be difficult to have the seller pay costs for the buyer. Therefore, I am also including a scenario where the 15% is used for the down payment, and the remaining 5% is used to pay the closing costs. This way, the buyer will not need funds to close, making this a true scenario where the buyer does not pay the down payment or closing costs out of pocket.

Example: 20% Shared Appreciation Loan for a $700,000 home in Orange County, CA

Authored by Tim Storm, an Orange County Loan Officer and Mortgage Advisor for Arbor Financial Group (NMLS ID 236669). MLO 223456. - Please contact me at 949-829-1846. I will prepare a custom Total Cost Analysis which will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of your scenarios so that you can fully understand the numbers BEFORE starting the loan process.