Is this a good time to buy a home in Southern California?

Are you considering whether now is the right time to buy a home in Southern California? Despite the slightly intimidating current mortgage rates, let me share two compelling reasons why it may still be an excellent opportunity to become a homeowner.

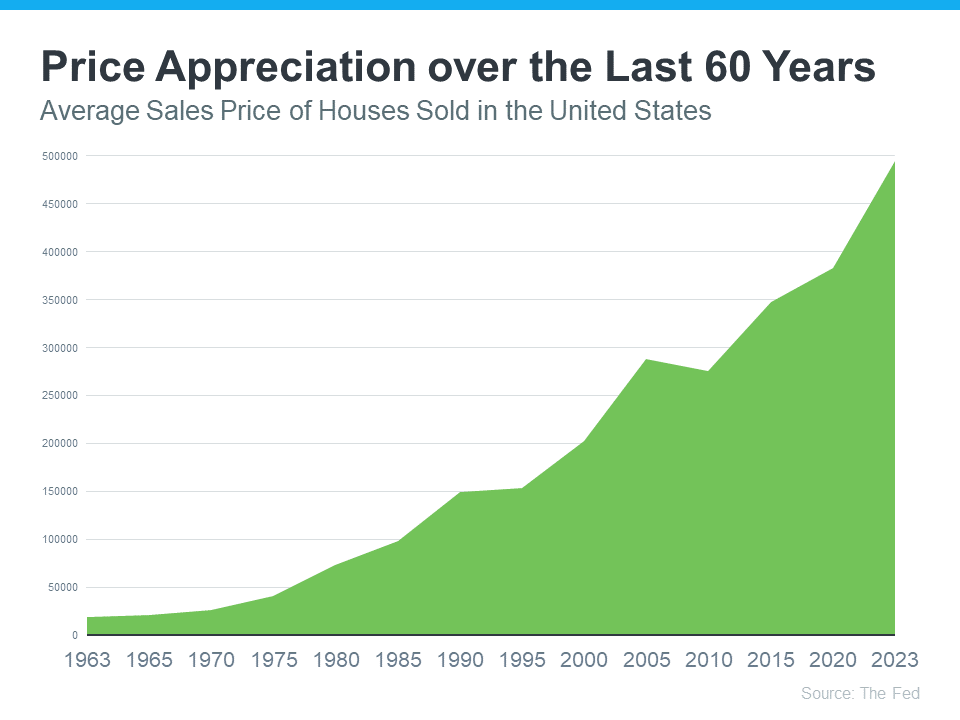

Reason 1: Home Values Appreciate Over Time – Although home prices experienced a minor dip in late 2022, the good news is they have been steadily appreciating at a more normal pace this year. The graph below shows the consistent long-term upward trend in home prices using data from the Federal Reserve over the past 60 years.

While there may be short-term fluctuations, history demonstrates that home values rise over the long run. This increase in value serves as a solid reason why buying a home makes more sense than renting. As home prices rise and you pay down your mortgage, you steadily build equity, thereby boosting your net worth.

Suppose you buy a California home today for $800,000 with 5% down. Assuming just 3% appreciation, your Return on Investment after only the first year would be 35%. (We assume $10,000 in closing costs and a 3% yearly appreciation.) The charts below show the estimated property value for the next 7 years, the cumulative appreciation after closing costs, and the Return on Investment (5% down payment). And if you’re a Veteran in California using 100% VA financing, your return on investment can’t even be calculated since you won’t have a down payment.

**Are you a Veteran looking for VA approved condos in Orange County, CA. Visit www.OrangeCountyVeteransHomes.com to find VA approved condos currently for sale.

Looking at these charts, the bigger question is, why would someone who can buy now not buy now? If they have short-term housing plans, meaning they may be moving out of state or to another area in the next few years, then it probably doesn’t make sense to buy right now. But for someone ready to settle down, waiting for rates or property values to drop is not a good plan. Think about it. Currently, thousands of potential homebuyers can’t afford a home based on current rates. They just don’t qualify. But if rates drop low enough, they’ll return to the market. And there are also a group of home buyers who do qualify for a home today but want to wait for rates to drop anyway. When rates do drop, do you think buying a home will be easier when competing with multiple offers on every property?

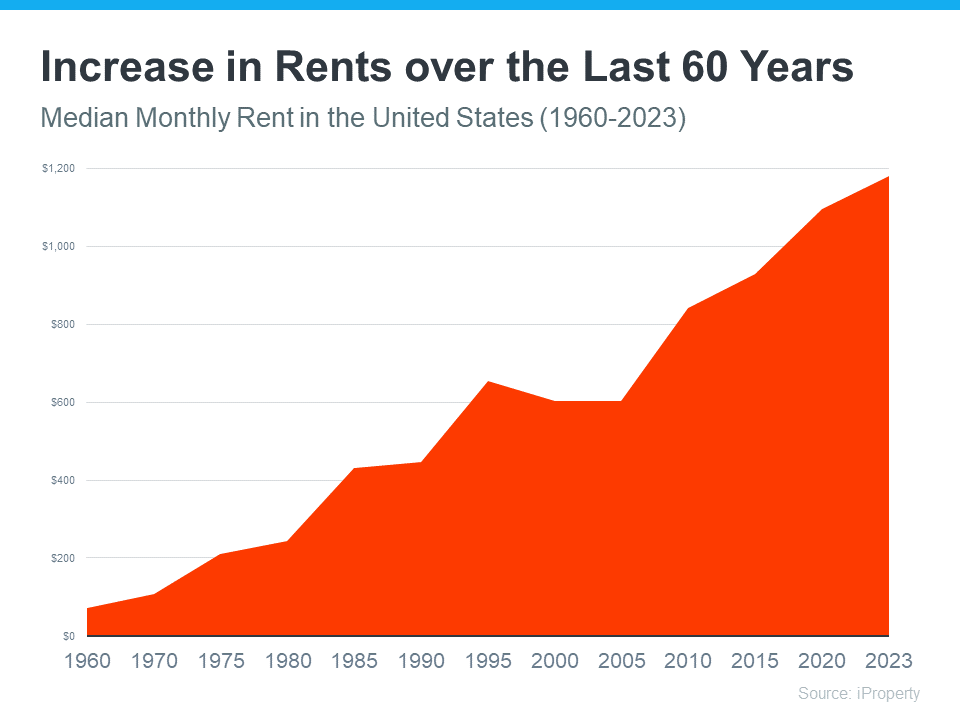

Reason 2: Rent Keeps Increasing – If you have ever experienced the frustration of annual rent hikes, you’re not alone. The graph below illustrates the steady climb in rental costs over the past six decades.

You can break free from the never-ending cycle of rent increases by purchasing a home. Homeownership allows you to lock in your monthly housing costs and achieve stability.

Ultimately, the choice is yours. Housing payments can be seen as an investment in yourself or your landlord. By becoming a homeowner, you invest in your future. Renting, on the other hand, means that money is gone forever.

Considering the consistent rise in home values and the relief from ongoing rent hikes, homeownership can lead to financial security. Dr. Jessica Lautz, Deputy Chief Economist and VP of Research at the National Association of Realtors (NAR), says,

“If a homebuyer is financially stable, able to manage monthly mortgage costs, and can handle the associated household maintenance expenses, then it makes sense to purchase a home.”

In conclusion, when you weigh the benefits, buying a home offers more advantages compared to renting. Get ready to embark on a homeownership journey and secure your financial future.

Authored by Tim Storm, an Orange County Loan Officer and Mortgage Advisor for Arbor Financial Group (NMLS ID 236669). MLO 223456. – Please contact me at 949-829-1846. I will prepare a custom Total Cost Analysis which will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of your scenarios so that you can fully understand the numbers BEFORE starting the loan process.